Financial Advice for Recent Graduates

Highlights:

- A realistic budget helps recent graduates manage their money and avoid financial surprises.

- Having strong credit can make it easier to qualify for loans, credit cards and housing.

- Checking credit reports often helps spot mistakes and help protect against identity theft.

Graduation is one of the biggest milestones in a young adult's life. It's a time to celebrate achievements and get ready for the future. It's also a time when financial needs often start to change.

There are some financial tips and tricks that can help recent graduates start strong.

Create a Budget and Stick to It

Having a clear budget can help new graduates manage their money better. Many experts recommend using the 50-20-30 rule.

- Fifty percent of income should go toward needs. These include things like rent, groceries, utilities and insurance.

- Twenty percent should work towards paying down debts like student loans or credit cards and to build savings.

- Thirty percent can be for extras like entertainment and dining out.

A realistic budget makes it easier to stay on track and avoid surprises. It's important to base the budget on real spending habits.

Start Building Credit Early

Good credit scores are important for getting loans and credit cards at lower interest rates. Good credit scores are even needed to rent an apartment and set up utilities. Graduates who don't have any credit will need to start building their credit history. Getting a credit card and being responsible with it is the simplest way to build credit. The account holder should plan for how to make the credit card payments and pay off the balance in full each payment period.

If getting a regular credit card isn't possible, a secured card might be a good option. This type of card requires a deposit, which becomes the credit limit. For example, a $500 deposit usually means a $500 limit.

Another way to build credit is by becoming an authorized user on someone else's credit card. The graduate can use the card, but the main cardholder stays in charge of the account.

It's also important to check credit reports often. Credit reports show payment history, balances and personal information. Reviewing the credit reports can help catch mistakes or signs of identity theft early.

If there's something you believe may be inaccurate or incomplete, contact the lender reporting the information first. Mistakes include wrong account balances, wrong credit limits or accounts that aren't theirs. If needed, they can file a dispute with all three major nationwide credit reporting agencies. They can check their Equifax® reports anytime through a myEquifax™ account.

Make a Plan to Pay Off Debt

Paying off debt is another big step toward financial stability. Graduates should start by adding up all their debts to see the full amount they owe.

There are two common ways to pay off debt.

- The snowball method means paying off the smallest debt first. Once it's paid off, focus on the next smallest debt.

- The avalanche method focuses on paying off the debt with the highest interest rate first. This method can help save more money in the long run.

With consistency, either strategy can work.

Understand Available Employee Benefits

Many jobs offer benefits like health, dental and vision insurance. Employees usually have to pay part of the monthly cost.

Graduates should review their choices and pick what fits their needs and budget. Someone healthy might choose a high-deductible plan to save money. Someone who needs regular medical care may want a plan with higher monthly costs but better coverage.

Many employers also offer retirement plans like 401(k)s or IRAs. Some match part of employee contributions, which is free money toward retirement savings. Taking full advantage of employer matching is a smart move.

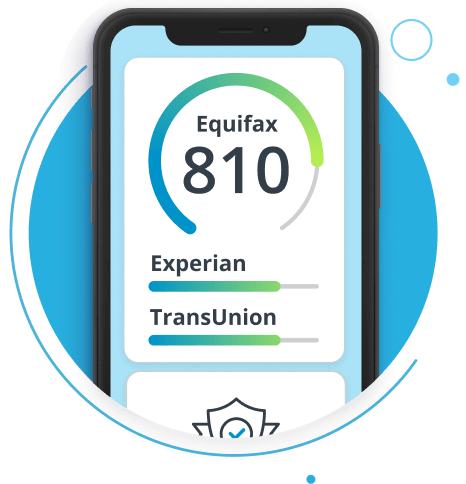

Track Credit With Equifax

Tracking credit scores is an important step for any recent graduate. Credit scores can help recent graduates get a better idea of their personal finances. As one of the three nationwide credit reporting agencies, Equifax is here to help. Equifax Complete™ Premier is great for every stage of a graduate's financial journey. This tool offers credit monitoring and identity theft protection.

Understanding the more complex aspects of money management is an important part of building a strong financial future.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.