What You Need To Know:

The credit score provided is a VantageScore® 3.0 credit score based on Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

Receive alerts of key changes to your Equifax credit report.

Should you become a victim of identity theft, our ID Restoration Specialists will work on your behalf to help you recover.

With up to $500k in ID theft insurance4, we'll help pay certain out of pocket expenses.

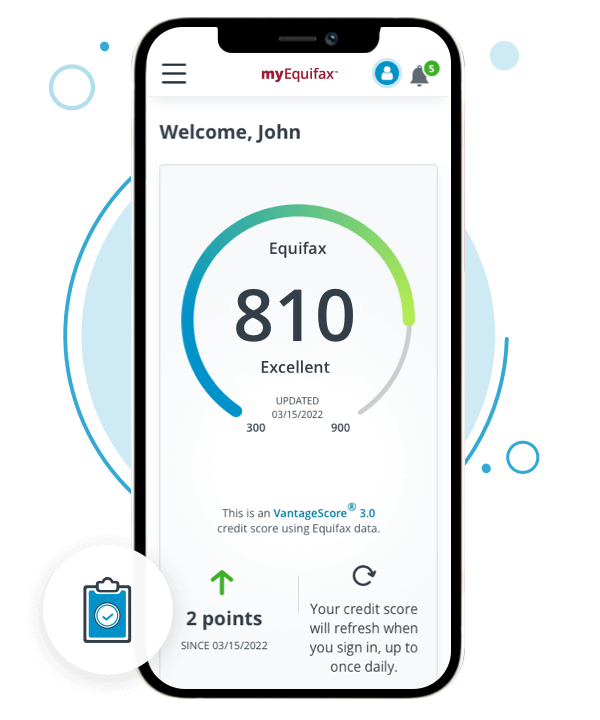

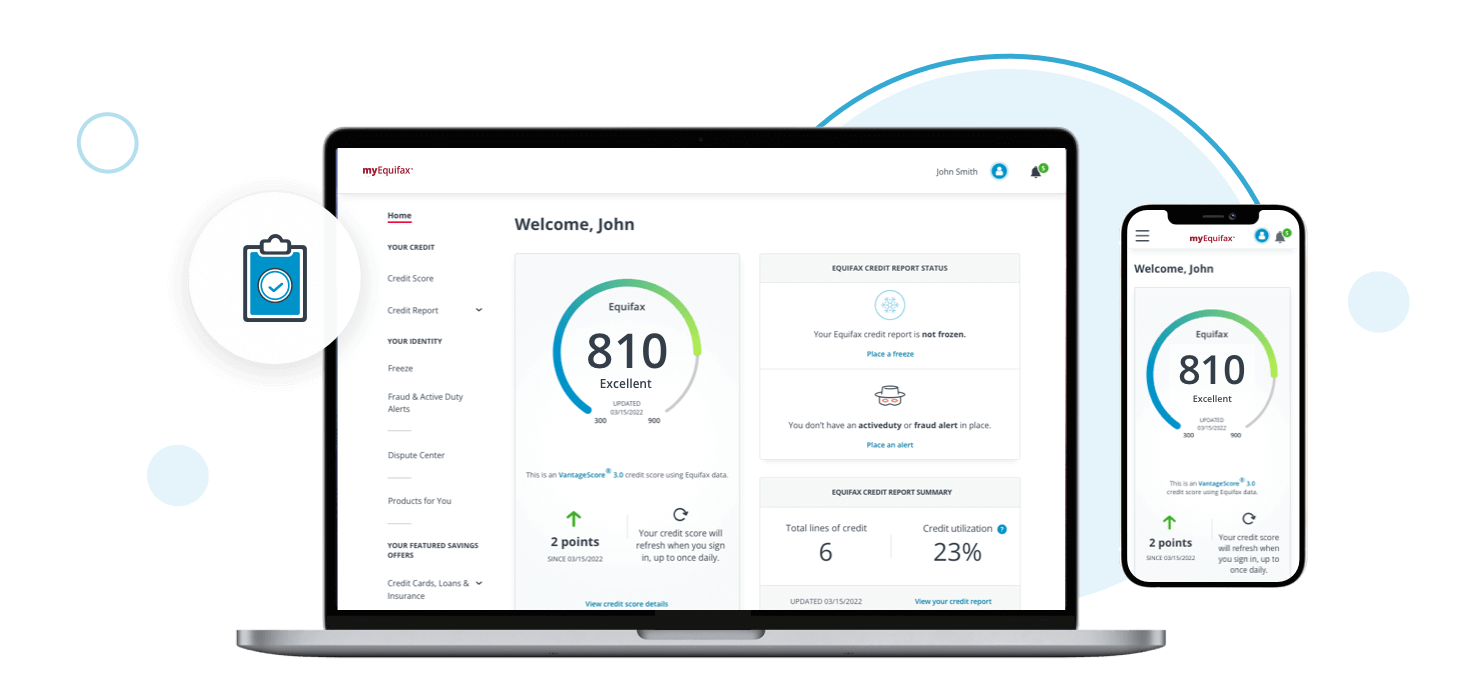

Access your credit status wherever you are

Automatic fraud alerts5

Identity restoration

Up to $500,000 in identity theft insurance4

Equifax Complete™ ID theft & credit monitoring product features

Your credit scores can fluctuate, and it’s important to know where you stand. Stay in the know with daily access to your VantageScore credit score.

You’ll know if key changes occur to your 1‑bureau VantageScore credit score, because we’ll be monitoring it and notifying you with custom alerts.

You’ll know if key changes occur to your Equifax credit report, because we’ll be monitoring it and notifying you with custom alerts.

Your credit reports are a summary of your credit history. Feel confident with the ability to check your Equifax credit report anywhere, anytime.

If you believe you’re a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report. This alert encourages lenders to take extra steps to verify your identity before extending credit. On an annual basis, we'll automatically renew your fraud alert, so you don't have to.

Feel more secure knowing your Equifax credit report is locked down from being accessed (with certain exceptions) for the purposes of extending credit.

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

We are here to help if you become a victim of ID theft. We provide up to $500,000 in coverage for certain out-of-pocket expenses related to having your identity stolen.

Cancel at any time; no partial month refunds.1

DETAILSHow to protect yourself from social security number identity theft.

Although there’s no way to totally prevent identity theft if your Social Security number is stolen, certain strategies can help lessen your risk.

The rise in online job scams: what to know.

With a little knowledge, you can learn to spot the warning signs of a job scam and avoid falling victim to fake employers.

We will require you to provide your payment information when you sign up. We will immediately charge your card the price stated and will charge the card the price stated for each month you continue your subscription. You may cancel at any time; however, we do not provide partial month refunds.

Credit monitoring from Experian and TransUnion will take several days to begin.

WebScan searches for your Social Security Number, up to 5 passport numbers, up to 6 bank account numbers, up to 6 credit/debit card numbers, up to 6 email addresses, and up to 10 medical ID numbers. WebScan searches thousands of Internet sites where consumers' personal information is suspected of being bought and sold, and regularly adds new sites to the list of those it searches. However, the Internet addresses of these suspected Internet trading sites are not published and frequently change, so there is no guarantee that we are able to locate and search every possible Internet site where consumers' personal information is at risk of being traded.

The Identity Theft Insurance benefit is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Equifax, Inc., or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

The Automatic Fraud Alert feature is made available to consumers by Equifax Information Services LLC and fulfilled on its behalf by Equifax Consumer Services LLC.

Locking your Equifax credit report will prevent access to it by certain third parties. Locking your Equifax credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax credit report include: companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer's identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Under certain circumstances, access to your Equifax Credit Report may not be available as certain consumer credit files maintained by Equifax contain credit histories, multiple trade accounts, and/or an extraordinary number of inquiries of a nature that prevents or delays the delivery of your Equifax Credit Report. If a remedy for the failure is not available, the product subscription will be cancelled and a full refund will be made.