Five Ways to Prepare Your Finances for the Holidays

Highlights:

- Holiday spending can get out of control if you do not pay attention.

- Budgeting can help you stay on track with your holiday spending.

- Be sure to include unexpected expenses into your holiday spending budget.

As the holidays get closer, you start to consider all the things you still have to buy. You have the gift lists, decorations and other seasonal purchases. With each shopping trip, your holiday spending ticks higher. If you aren't careful, you could lose control and spend more than you expected. If you want to better manage your money in the New Year, start your holiday planning now.

Make a holiday budget before the holidays.

Make a list of all your essential holiday-related expenses. Be as specific as you can. Extra expenses like stamps for holiday cards or more wrapping paper can add extra costs. Decide how much money you can afford to spend in total. Then, divide it up by item, recipient, delivery date, and potential sales. It's important to stick to the plan as the season progresses. It's easy to get caught up in holiday cheer or caught off guard with last-minute purchases. Setting a budget in advance will help you figure out how much money you can devote to each expense. This includes gifts, food, entertaining and other holiday cheer.

Be careful of spending on your credit cards.

Credit cards can be a useful tool to cover some of your holiday spending. That said, it's important not to get so carried away that you overuse or even max out your available credit. Before mapping out your holiday spending, make a list of how much debt you already have on your credit cards. Also, be aware of how that debt reflects your total debt-to-credit ratio. Most lenders prefer to see this at or below 30 percent. Set a hard limit on the amount of credit you'll use this season and do not spend more than you can pay back.

Save now, spend later.

Socking away small, affordable amounts is a great way to build a lifelong savings habit. It can also take the edge off when it comes to the holiday season. Find a way to set aside a few dollars from each paycheck. Make sure that cash goes into a separate savings account. If you save $5 per day, that's $35 per week or $1,820 over the course of a year. You can use this to fund your holiday spending, pay down debt or prepare for retirement. Once you get used to saving $35 each week, try upping that to $40 and then $50. You'll create a manageable savings strategy that will help develop true financial stability.

Get crafty when you can.

Nothing says “I love you” quite like a homemade gift. Plus, it ensures the recipient will become the proud owner of a one-of-a-kind item or get to enjoy a tasty treat. If you're not crafty but can't buy something for everyone, create your own “gift cards.” For example, you could pledge to help a relative or friend clean their home. You could also volunteer to babysit for friends with children who could use a night out. The spirit of giving shows someone you care about them. Some gifts—whether you spend money, make something or donate your time—are priceless.

Make your travel plans as early as possible.

Holiday travel becomes more chaotic with each passing year. More than 115 million Americans tend to travel during the holidays. If you plan to travel for the holidays, flights, rental cars and paying for gas or other travel expenses can add up. Airlines, train stations, hotels and others charge higher rates around the holidays. Those prices only rise as year-end approaches.

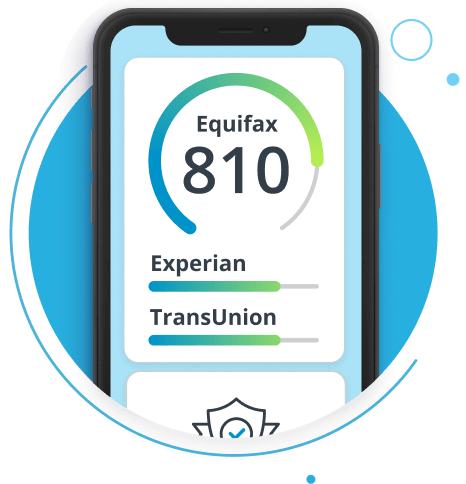

How Equifax® can help you save for the holidays.

You may wonder how you can afford to bring the holiday magic. It's hard to not get sucked into the spending cycle. With Equifax Complete™ Premier, you can view your Equifax credit report at any time. And you'll also have annual access to your 3-Bureau credit report in one place. Plus, if we find your information on the dark web, we'll alert you. With a bit of planning and budgeting, you can get through the end of the year with your finances intact.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.