Student Loan or Personal Loan: Which Should I Choose?

Highlights:

- Federal student loans are often an ideal choice for college. They offer lower interest rates and flexible repayment options.

- To get a federal loan, you must fill out the FAFSA®, and most students qualify but there are some exceptions.

- Private student loans and personal loans are harder to get. They usually have higher interest rates, which can lead to higher monthly payments.

College is exciting, but it can also be expensive. There are many ways to finance your college tuition, such as grants and scholarships. If grants and scholarships don't cover all your costs, you might need a loan. There are two main types of loans you can consider: a student loan and a personal loan. Not sure if you should get a student loan or a personal loan? Here's what you need to know.

Benefits of using a student loan for college

Student loans can help pay for tuition, housing, books and other school expenses. There are two main types of student loans. Federal student loans come from the government. They usually have lower interest rates and are easier to repay. The interest rate stays the same, so your monthly payments won't go up. Private student loans come from banks and may have variable interest rates. That means the rate can change, and you might end up paying more over time.

For most students, federal loans are the better and more affordable option. To get a federal student loan, you need to fill out the Free Application for Federal Student Aid (FAFSA). This form asks about your school plans and finances. The government uses your answers to figure out how much aid you can get. Most students qualify, but there are some exceptions. You may not qualify if your Social Security number isn't valid or if you don't meet the citizenship rules. You also need to have not defaulted on a federal loan or have a serious criminal conviction. Private student loans are usually harder to get. You may need a strong credit score, steady income or a co-signer. That's why many students start with federal loans first. They're often easier to get and come with better repayment options.

Student loans, especially federal loans, usually have lower interest rates than other loans. They're also easier to qualify for and offer flexible repayment plans. This makes it simpler to manage monthly payments and fit them into your budget. You can also deduct up to $2,500 in student loan interest payments when filing your tax return.

Can I use a personal loan for college?

This depends on your lender and what they allow you to use a personal loan for. Some personal loans are flexible while others are rigid. If you decide to use a personal loan, you may be able to use it for tuition, housing, food, textbooks, and more. But, they usually come with higher interest rates than student loans. This means borrowing can cost more over time and may lead to higher monthly payments. You will also need to start repaying your personal loan immediately. Plus, there aren't any protections, forgiveness programs, or tax benefits with personal loans.

Which type of loan should I apply for?

Student loans and personal loans are similar. You borrow money and pay it back in monthly installments over time. Both types of loans also include interest on the amount you borrowed.

There are some big differences between student loans and personal loans. Student loans tend to have more flexible terms. With student loans, there are several repayment options. With a personal loan, the lender controls your interest rate and monthly payment. You also don't need to worry about paying your student loans until after graduation. With personal loans, you need to start paying it back immediately. Plus, you can get tax benefits with student loans, but you can't with personal loans.

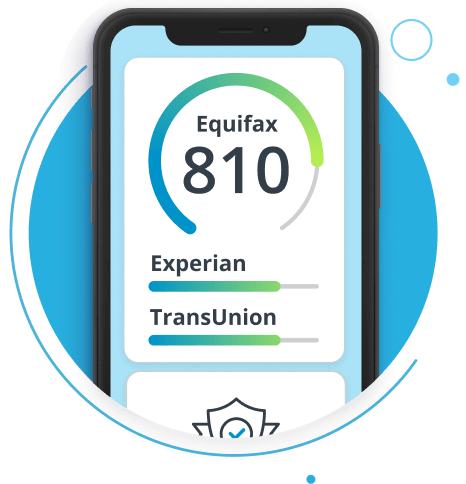

Keep track of your credit with Equifax®

Lenders offer different types of loans, so it's important to choose the right one for your needs. Once you have a loan, you can check your credit reports to make sure the lender is reporting the correct balance and payment history. Equifax Complete™ Premier can help you track your credit and uncover potential fraud with credit monitoring and alerts.

College can be costly, but there are ways to make it easier to manage.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.