Is It Fake? How To Identify Deepfake and AI Scams

Highlights:

- A deepfake is a fake image, video or audio clip that uses AI to mimic real people or situations. It can trick people into sharing personal or financial information.

- AI scams can look or sound real, which makes them harder to spot. Scammers use them to create urgency and pressure people into acting.

- Deepfakes have signs like mismatched lips, robotic voices or blurry visuals. Messaging that feels rushed or asks for odd payment methods may also be a warning sign.

- If you come across a deepfake or AI scam, take steps to protect yourself. Report the scam, review your privacy settings and freeze your credit if needed.

Your identity is one of your most valuable assets. You use it every day when you apply for a job or open an account. As technology evolves, protecting that identity has never been more important. Artificial intelligence, or AI, has made life more convenient in many ways. But it has also created new risks. Scammers are using AI to make realistic fake videos and messages called deepfakes. These can look and sound real, which makes them easy to fall for. Knowing how to recognize deepfakes and AI scams can help prevent identity theft.

What are deepfake and AI scams and how do they work?

A deepfake is a video, photo or sound clip that someone has changed using AI. It can make a person appear to say or do something they never did. Scammers use this technology to copy faces, voices or styles of speech.

AI scams rely on technology that learns how people talk or behave. Then it creates fake messages or videos that seem real. You might get a call that sounds like someone you know or see a video of a public figure making false claims.

These scams work because they play on trust. When a message looks familiar or feels urgent, it is easy to react to it. Scammers count on that moment of pressure to get you to send money or share personal information.

How can you identify deepfake and AI scams?

Even though deepfakes are getting more advanced, there are clues that can help you spot them.

Audio and video signs

- Faces or mouths move out of sync with the words.

- Robotic or flat voices that do not show emotions.

- Blurry or uneven lighting in the background.

- Phrases that sound repeated or unnatural.

Messaging signs

- Sudden urgency, such as “act now” or “time is running out”.

- Emotional manipulation or fear tactics.

- Unusual requests, like sending gift cards or transferring money.

Payment signs

- Requests for cryptocurrency or wire transfers.

- Demands for payment through prepaid gift cards.

- Messages asking for personal or banking information.

If something feels off, pause before you respond. Verify what you are seeing or hearing before taking action.

What should you do if you encounter a deepfake or AI scam?

If you think you have come across a deepfake or AI scam, you need to take immediate action. First, confirm if the message is real by contacting the person or company through a trusted phone number or website. If it is a deepfake, report the scam. Contact the Federal Trade Commission or your local consumer protection agency. You should also review your website privacy settings and make your social media private. Update your passwords and turn on multi-factor authentication where possible. You should also consider freezing your credit. This works to help stop scammers from opening new financial accounts in your name. These actions can reduce your risk and make it harder for scammers to use your information again.

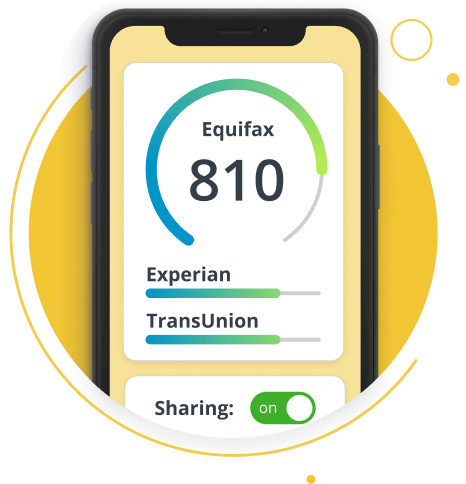

Help protect your identity with Equifax®

Equifax knows how important it is to help protect your identity in an AI-driven world. Our products help you protect your personal information. If something suspicious appears online, including on the dark web, we can alert you. With Equifax Complete™ Premier, you can help safeguard your identity. If you want to protect your loved ones, the Equifax Complete™ Family Plan offers the same security for your family. Being aware of new AI scams can help you stay in control of your financial future.

Gain greater peace of mind by monitoring your family's credit card numbers, social security numbers, & bank accounts with Equifax Complete™ Family Plan.