How to Recover from Identity Theft

Highlights:

- Identity theft involves using your name, Social Security number or other personal information without your permission.

- It can take several months to recover from identity theft.

- Trustworthy agencies can help, but look out for common credit-repair scams.

Identity theft is an unfortunate crime on the rise. It happens when a person steals your name, Social Security number and other private data. They then use your information to apply for loans, credit cards and other lines of credit. If they don't pay those bills, your credit scores can drop.

There are some common signs you might be a victim of identity theft.

- Have you had unexplained withdrawals from your bank account?

- Have you received bills or debt collection notices you don't recognize?

- Has a creditor denied your application for no reason?

- Did you find loans or credit cards on your credit reports that you didn't apply for?

If you answered yes to any of these, you may be a victim of identity theft.

How can I rebuild my credit after identity theft?

If you're a victim of identity theft, here are steps you should take.

- 1. Freeze your Equifax® credit report

Placing a security freeze on your Equifax credit report prevents access to it for the purpose of opening credit in your name. A security freeze is one step you can take to help prevent access to your Equifax credit report to open credit accounts, with certain exceptions. Before applying for credit, you will need to lift the security freeze so that potential creditors can access your Equifax credit report. - 2. Report the theft

File a police report and submit an identity theft report with the Federal Trade Commission at www.identitytheft.gov. - 3. Check your credit reports

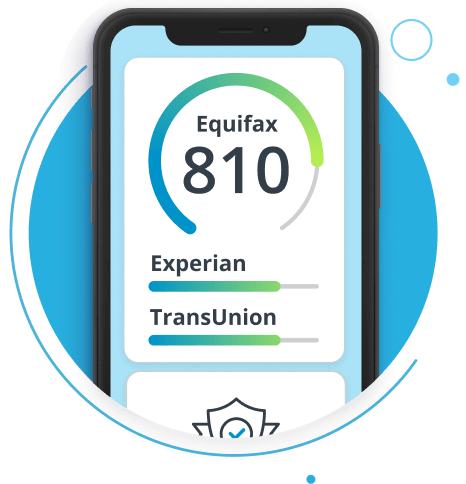

You should check your credit reports and look for any unrecognized accounts or credit inquiries. You can create a myEquifax™ account to get free Equifax credit reports. - 4. Collect proof

You'll need documentation to support your claims, so gather the following.

- Credit reports

- Bank and credit card statements

- Public records (bankruptcies, judgments, etc.)

- Credit applications

- 5. Submit disputes

If you see information on your credit reports that you believe is inaccurate or incomplete, contact the creditor/lender first because you may be able to straighten out the matter with them. You can also file a free dispute with the three nationwide credit reporting agencies (NCRAs) — Equifax, Experian®, and TransUnion®. A dispute is an official request to investigate inaccurate or false information. Filing a dispute is free. - 6. Inform collectors

If a debt collector calls about an account you didn't open, let them know you are a victim of identity theft. Be ready to share a copy of your police or FTC report if needed. - 7. Check and update your accounts

Sometimes, identity thieves gain access to existing credit cards and bank accounts. If that happens, you may need to close them or get new card numbers. Also, update your automatic payment info so your bills still get paid on time.

How long will it take to recover from identity theft?

Once fraudulent charges and accounts are removed from your credit reports, your credit scores should start improving — but it takes time. How long it takes depends on things like how many accounts the thief opened and how soon you caught the theft. In most cases, it takes at least a few months to see progress.

During this time, it's important to check your credit reports. Checking your credit reports can help you detect any inaccurate or incomplete information and verify that your efforts to rebuild your credit are working.

Can I trust credit repair agencies?

Some credit repair agencies can help you through the recovery steps. Others are well-disguised scams. They promise quick fixes and charge high fees but can make the situation much worse. You should be especially careful of credit repair agencies that give bad advice, such as not to contact any of the three NCRAs. Don't listen if they tell you to dispute every negative item on your credit reports, even the ones that are true. Doing this can make it harder to prove that you were a victim of identity theft.

Scam agencies may even charge you for services they don't perform. Some may even attempt to create a new identity in your name. Both of these scenarios can put your real credit scores at risk. To avoid these scams, look for a nonprofit credit counseling agency. Try to avoid a for-profit business advertising credit-repair services.

How to help better protect your identity with Equifax

It's normal to feel stressed or overwhelmed when someone steals your identity. Identity theft can affect your credit and your ability to get approved for new accounts. This is why it's so important to take immediate action. Equifax Complete™ Premier alerts you to suspicious activity and shows you key changes to your credit reports. We want to help you stay informed and in control of your identity.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.