Keeping Up with Credit Card Debt During a Financial Crisis

Highlights:

- Credit card debt can hurt your credit history.

- There are smart strategies to follow when using credit cards.

- There may be credit card debt relief options through your credit card issuer.

Many people rely on their credit cards to help cover mounting bills and other essentials. In times of financial crisis, credit cards can be a vital tool. But if you spend more than you can pay back and leave debt unchecked, it can hurt your credit history. This can lead to even bigger financial problems.

Positive Credit Card Habits

If you use credit cards, be sure to engage in these positive credit card habits.

- Always make at least the minimum monthly payment. A minimum payment is the lowest amount you can pay on your credit card to keep your account in good standing. You can always pay more than this amount and it's better to pay your balance in full. If you're unable to keep up with your minimum payments, the creditor will mark your payments late. Late payments can drag down your credit scores and may stay on your credit history for up to seven years.

- Avoid canceling your credit cards, even if you're not using them. If you're trying to avoid spending money you don't have, it may seem logical to cancel your credit cards. Keeping your accounts open but not using them can improve your credit utilization rate (or debt to credit ratio). This compares the amount of revolving credit you are using to your total available revolving credit. Also, your credit reports track the amount of time your credit accounts have been active. If your credit card is your oldest account on your credit report, it could cause a hit to your credit scores.

- Take advantage of credit card rewards programs. Depending on the type of credit card account you have, you may be able to accumulate reward points. Types of rewards include gift cards, discounts on food delivery and travel rewards. If you're already using your credit card, check to see what rewards your credit card issuer offers.

Credit Card Forbearance

The credit card debt relief options available to you will vary. Some card issuers offer forbearance or credit card hardship assistance programs. These can let you negotiate with your card issuer to temporarily provide relief during financial hardship, whether that's an adjustment to your monthly payment, credit line extension or reduced interest rates. However, credit card forbearance can have serious effects on your account and credit scores, so it's important to know whether the program is worth it in your unique situation.

Some programs may need proof that your finances have changed due to a job loss or reduction in hours at work. You may need to provide the necessary documentation. With a modified payment plan with your credit card company, you need to know what you're signing up for. Here are some clarifying questions to ask your credit card issuer.

- If we are able to defer my monthly payments, will interest continue during this period?

- How long will this relief last? Can I get an extension if my financial situation is the same when the forbearance period expires?

- What information will be shared with the nationwide consumer reporting agencies?

- Will I still be able to use my credit card for purchases during this relief period?

Make sure to get any agreement you reach in writing. Check your credit card statement monthly to make sure everything is correct.

Checking your credit report with Equifax® is as easy as 1-2-FREE

You should check your credit reports to ensure your credit card payments are correct. Your credit card issuer could make a mistake. For example, they could report your payments as late even though they agreed to defer your payments. As long as you adhere to your agreed upon terms, they should report your payments as “current”.

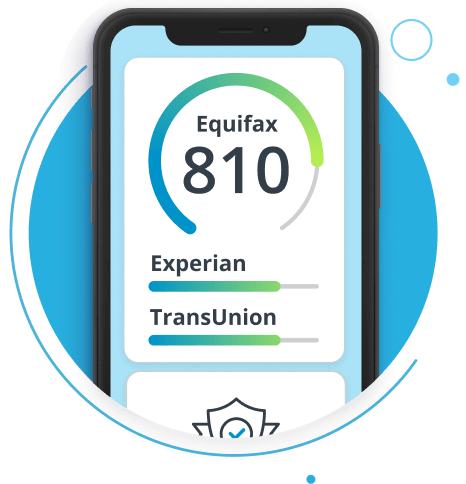

Remember to check your credit reports regularly. You can check your Equifax credit report at any time through your myEquifax™ account. Look for "Equifax Credit Report" on your myEquifax dashboard. You can also get your free Experian® and TransUnion® credit reports at annualcreditreport.com.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.