Will Checking Your Credit Hurt Credit Scores?

Highlights:

- Checking your credit reports or credit scores will not impact credit scores.

- Checking your credit reports and credit scores helps to ensure information is accurate.

- Hard inquiries in response to a credit application do impact credit scores.

Many people are afraid to request a copy of their credit reports or check their credit scores. They worry it may have a negative impact on their credit scores.

Good news: Credit scores aren't harmed when you check your own credit reports or credit scores. In fact, checking your credit reports and credit scores could actually help you. It is an easy way to ensure your personal and account information is correct. It may also help detect signs of potential identity theft.

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, that's known as a “soft” inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a “hard” inquiry. After you have applied for a loan or a credit card, the potential lender reviews your credit history.

Hard inquiries do affect credit scores. If you are buying a house or securing a mortgage, this will lead to a hard inquiry. If you shop around for the most competitive rates, there may be several hard inquiries. These are generally treated as one hard inquiry for a given period of time, usually 14 to 45 days. That allows you ample time to check different lenders and find the best loan terms for you. This multiple-hard inquiry exception generally does not apply to credit cards. Find out more information on hard inquiries and your credit.

Getting your credit reports

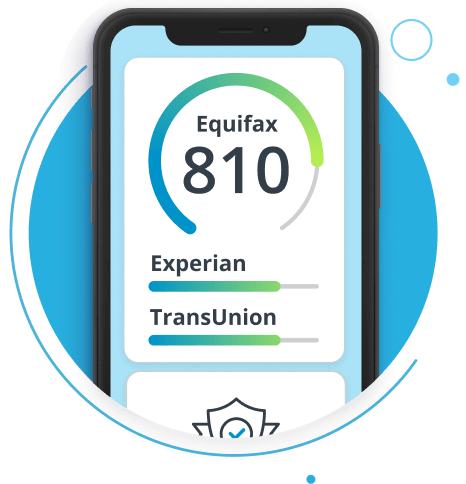

It's a good idea to check your credit reports at least once a year. You can get a free copy of your credit reports by visiting www.annualcreditreport.com. You can also get a free copy of your Equifax® credit report by creating a myEquifax™ account.

When looking at your credit report, review your personal information for accuracy. Make sure that you recognize all the information on your credit report. You should also make sure your account information is accurate and complete. Do the account balances, credit limits, and payment history look accurate? Is there account information listed that you don't believe is yours?

If you see account information that is inaccurate or incomplete, contact the lender. You can also file a dispute with the credit bureau providing the credit report. At Equifax, you can create a myEquifax account to file a dispute. Visit our dispute page to learn other ways you can submit a dispute.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.