How Often Does Your Credit Score Update?

Highlights:

- Your credit scores are not fixed numbers and will change over time based on your financial behavior.

- For your credit scores to update, the information in your credit reports must update.

- It's up to your creditors when and how often they will report to Equifax®, Experian® and TransUnion®.

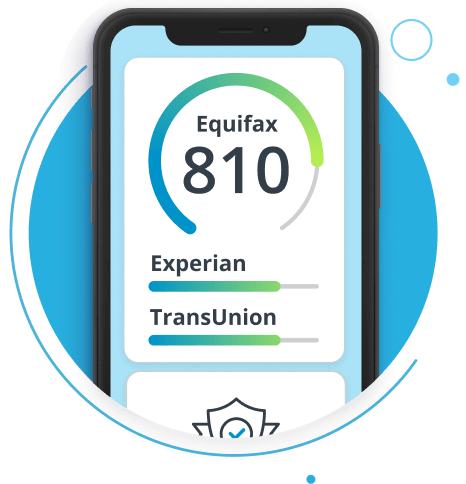

A credit score is a three-digit number that comes from information on your credit reports. It represents your credit risk, or the likelihood you will pay your bills on time. Credit scores are not fixed numbers. They will change over time based on your financial behavior. But how often will your scores update? And do you need to do anything for them to update? Continue reading to answer these questions and more!

How often are credit scores updated?

Your credit scores usually update at least once a month. This may vary depending on your unique financial situation. Credit scores are calculated based on the information included in your credit reports. So, for your credit scores to update, the information in your credit reports must first change. A credit report is a summary of your financial behavior over time. It includes information about the number and types of credit accounts you have. It also shows your payment history, the total credit available and other information.

How do credit reports get updated?

Credit reporting is voluntary. Not all lenders report to the three nationwide credit reporting agencies (NCRAs). It's up to each individual lender to decide which NCRAs they report to, if any. It is also up to them to decide when they will report to each NCRA. Lenders that choose to report do so monthly. Credit card companies usually report by a recurring date known as the billing cycle. But the exact day of the month may be different for each provider.

In short, there's no set day that all lenders deliver information to the NCRAs. Additionally, not every lender or creditor will share information with every NCRA. Some may report to only one or two, or none at all. When it comes to your credit scores, updates usually occur at least once a month. They could be more often depending on how many lenders you have and when those lenders report.

How does Equifax update my credit score?

You can get a free Equifax® credit report and a free VantageScore® credit score by enrolling in Equifax Core Credit™. This credit score is a VantageScore based on Equifax data. A VantageScore is one of many types of credit scores. You will need to sign into your myEquifax™ account to see your changes to your credit score. If you want to check your credit reports with all three NCRAs, sign up for Equifax Complete™ Premier.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.