What Is a Credit Report and What Is on It?

Highlights:

- Your credit reports are important pieces of financial information. They help lenders measure your level of credit risk, or the likelihood you'll pay your bills on time.

- Your credit reports include information about the credit accounts you've had. It also shows your payment history and other information like your credit limits.

- Credit reports come from the three nationwide credit reporting agencies. These reports may contain different account information.

Your credit reports are important pieces of financial information. They help lenders measure your level of credit risk, or the likelihood you'll pay your bills on time. So, it's important to understand what a credit report is, as well as what you'd expect to find on one.

What is a credit report?

A credit report is a summary of your credit history. It includes the types of credit accounts you've had and your payment history. There is other specific credit information included such as your credit limits.

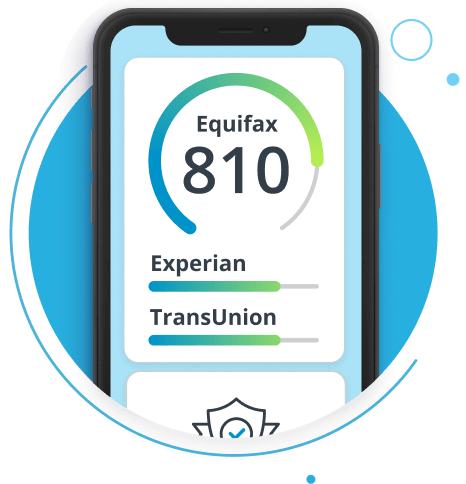

Your creditors decide which nationwide credit reporting agencies (NCRAs) they report to. That information is then sent to the NCRAs (Equifax®, Experian®, and TransUnion®). They compile this information and create your credit report. You may see differences in your credit reports depending on which NCRA provides them. This is because not all lenders report information to all three NCRAs. Some report only to one or two, or even to none at all.

How is your credit report used?

Lenders use your credit reports when deciding whether to extend you credit and at what terms. Additionally, the information on your credit reports is what's used to calculate your credit scores. Prospective employers and landlords may also need to view your credit reports. It can help them decide whether to offer you a job or a lease. If you're trying to get insurance coverage, they may also need to review your credit reports. If you're applying for utilities or a mobile phone contract, they may also pull your credit reports.

What is in an Equifax credit report?

Your Equifax credit report contains the following types of information.

- Identifying information. This section of your Equifax credit report is not used to calculate your credit scores. It includes things like your name, address, Social Security number and date of birth.

- Credit account information. Your creditors send Equifax this information. It includes the types of accounts (like a credit card or loan) and the date you opened those accounts. It also details your credit limit or loan amount, balances and your payment history. Your credit report may not contain all your credit accounts. A closed account will drop off your report after a certain period of time. It is also possible that an account is not reported to Equifax by one of your creditors.

- Inquiry information. There are two types of inquiries: “soft” and “hard.” “Soft” inquiries may happen when you check your own credit reports. If companies extend you a pre-approved offer of credit, it could also cause a soft inquiry. Your current creditors may also conduct account reviews, leading to a soft inquiry. Soft inquiries do not impact credit scores. Checking your credit reports can also help you spot suspicious activity from potential identity theft. “Hard” inquiries occur when companies or lenders review your credit reports. They only do this when you apply for credit or a service – for example, a new loan, a credit card or a mobile phone contract. Hard inquiries remain on your credit reports for up to two years, and may impact your credit scores. Hard inquiries are one of the factors that determine your credit scores.

- Bankruptcies. Bankruptcies remain on your credit report for 7 to 10 years, depending on the type of bankruptcy. A Chapter 7 bankruptcy is visible on your credit report for up to 10 years, and Chapter 13 for up to 7 years.

- Unpaid child support and alimony. It's also possible for unpaid child support or alimony payments to end up on your credit report. They can remain there for up to 7 years, even if the account is later paid in full. Paying the account will not remove it from your credit report. But it may lessen the impact that the overdue account has on your credit score.

- Collections accounts. If your debt has gone to a collections agency, it will show up on your credit report. There are certain types of accounts that can go to a collection agency. These include credit, retail, cable and mobile accounts. Effective July 1, 2022, medical debt sent to a collection agency that you have paid off will no longer appear on any credit report. Also, a landlord may seek payment by selling your rent debt to a collection agency. The unpaid rent sold to a collection agency can be in your credit report for up to 7 years.

How to get your Equifax credit report

It's important to check your credit reports often. It's also wise to track your credit scores to make sure there are no potential signs of identity theft. You can receive free Equifax credit reports with a myEquifax™ account. Sign up and look for "Equifax Credit Report" on your myEquifax dashboard.

It's important to stay on top of your credit. With Equifax Complete™ Premier, you can view your 3-bureau credit report annually. Plus, it comes with tools to help protect your identity with Dark WebScan. You can also get free credit reports at AnnualCreditReport.com.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.