Spot Troubled Accounts and Fraud Early

Your customers’ financial situations are constantly changing as they continuously face new challenges that impact their wallets — especially now.

Our account management solutions can help you assess risk across your customer and business lending portfolios and react quickly to changes. Enhance your account monitoring with a broad view of your accounts’ financial behaviors and capacity. Use our traditional credit, alternative, and economic data, as well as fraud solutions to better assess risk, spot troubled accounts early, and limit losses.

Team with Equifax to:

- Actively monitor accounts and gain a broad view of their ability to pay debt commitments

- Gain insights on customers’ credit activity at other firms

- Identify troubled accounts at risk of delinquency or default

- Inform line management and credit line changes

- Contain costs for collections and recovery and limit losses due to account fraud

- Track macro credit trends that could impact your portfolio

Optimize Your Account Reviews to Better Spot Risk

Manage Consumer Credit Account Risk

Protect Against Fraud

Manage Business Account Risk

Use alternative data to find accounts with 40% greater chance of delinquency.

Early insight into account changes “off you” can increase cost savings up to 50% on newly identified dollars at risk.

Portfolio analysis for one client found 62K+ synthetic identity accounts that could generate $8M+ in losses in one year.

Boost Your Account Management to Mitigate Losses

React Quickly to Changes in your Customer Accounts

Get more from your account reviews by understanding and reacting to changes quicker and more efficiently.

Source: Equifax analytics and case studies. Results may vary.

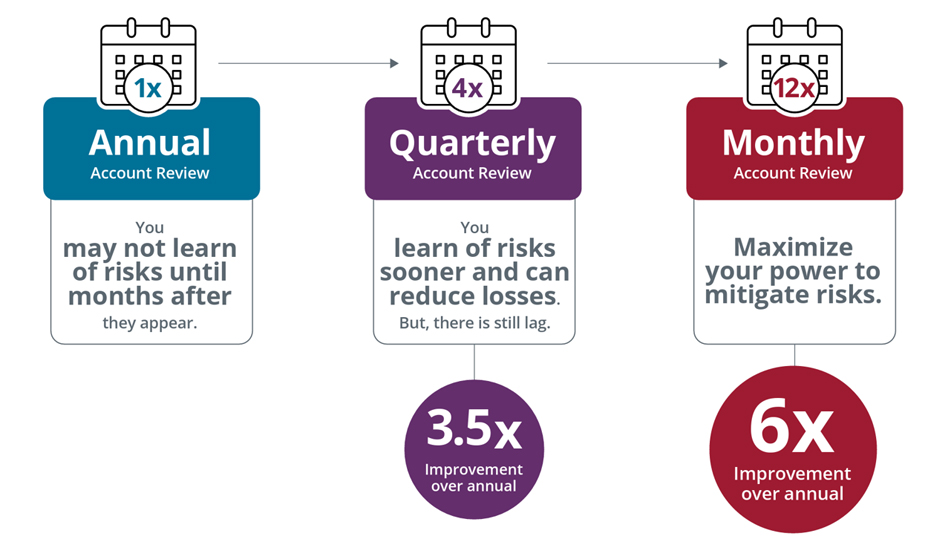

Value of Frequent Reviews

By reviewing lending accounts frequently you can increase cost savings by 40%-50%. See how early risk and retention signals can identify new dollars at risk.

Portfolio Insights Dashboard

Our dashboard can help you assess the health of your lending portfolio. Identify segments that present increased risk so you can initiate a full account review.

Track Lending Trends

Benefit from macro lending insights to help you quickly react to market changes. Receive monthly updates on delinquencies and balances and benchmark to competitors.

Analyze Your Portfolio

Learn how our Portfolio Insights Dashboard can help you spot risk across your portfolio. Gain insights with easy, on-demand access to detailed data visualizations of portfolio performance to clearly see and understand exactly what’s happening with your customer accounts and take fast action. Analyze tradelines, benchmark to peers, assess delinquencies, and inform collection strategies.

Expand Customer Relationships

Grow relationships and deepen customer connections. Explore our solutions to help identify accounts for cross-sell, promote usage, and enable customers to better manage their credit.

Need Help Deciding?