Are Scores from FICO and VantageScore Different?

Highlights:

- FICO and VantageScore are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

Did you know you don’t have only one credit score? There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports.

Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use your credit scores to help determine whether to approve your application for credit. Before approving you, they want to know: What’s the likelihood you’ll pay your bills on time? Lenders generally also have their own lending criteria, which may include other factors, such as your income.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus – Equifax, Experian and TransUnion.

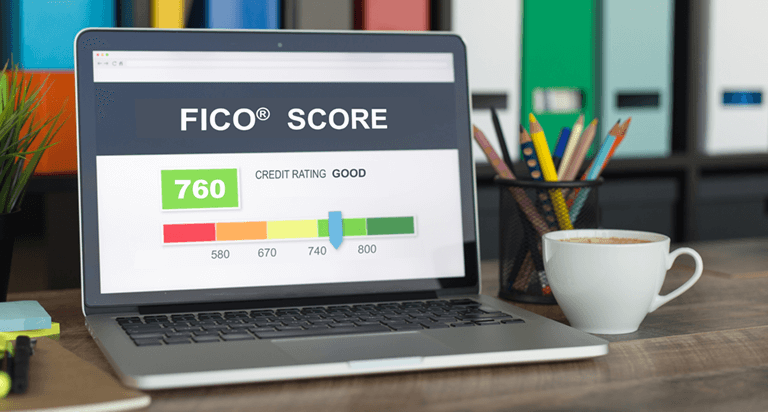

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850.

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

- Your payment history (35%)

- The amounts you owe, or credit utilization (30%)

- The length of your credit history (15%)

- The mix of your credit accounts (10%)

- Your new credit accounts (10%)

VantageScore is calculated with six categories of information contained in your credit reports. It doesn’t assign percentages to how much weight the categories are given, but instead describes their level of influence:

- Your payment history (extremely influential)

- Your credit utilization, or the percentage of your credit limits you’re using (highly influential)

- The length of your credit history and your mix of credit accounts (highly influential)

- The amounts you owe (moderately influential)

- Your recent credit behavior (less influential)

- Your available credit (less influential)

However, there are some differences between the two to highlight:

Length of credit history – To have a FICO score, consumers must have one or more credit accounts that have been open for at least six months and has been reported to the three nationwide credit bureaus within six months. VantageScore credit scores can be calculated if consumers have one or more credit accounts that have been open for at least one month and one account reported within the past two years.

What does this mean for you? If you're new to credit or haven't used your credit accounts in a while, you may not have a FICO credit score, but you may have a VantageScore credit score.

Hard inquiries – if you’re applying for a vehicle or student loan and shopping around for the best loan terms, both FICO and VantageScore count multiple hard inquiries for the same purpose on your credit reports as one inquiry for a certain period of time to minimize the inquiries’ impact on credit scores. The time period, however, generally differs. FICO uses a 45-day span, while VantageScore uses 14 days. And while FICO only includes mortgages, vehicle loans and student loan inquiries, VantageScore will do the same for hard inquiries dealing with other types of credit, including credit cards.

One note: All mortgage loan inquiries within about 45 days count as one inquiry, according to the Consumer Financial Protection Bureau.

Collection accounts – If your past-due account is sent to a collection agency, it may impact your credit scores from either company. But FICO generally ignores smaller collection amounts, when the original balance is below $100. VantageScore, meanwhile, doesn’t factor in paid collections, but includes all unpaid collections regardless of amount.

If you are applying for credit, you might consider asking which credit score the lender will use to evaluate your request. There is no one credit score used by all lenders and creditors, since there are so many credit scoring models. But knowing the differences in calculation methods can help you better understand what lenders may see when accessing your credit scores.

You can create a myEquifax account to get six free Equifax credit reports each year. In addition, you can click "Get my free credit score" on your myEquifax dashboard to enroll in Equifax Core Credit™ for a free monthly Equifax credit report and a free monthly VantageScore® 3.0 credit score, based on Equifax data. A VantageScore is one of many types of credit scores.

Get your free credit score today!

We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required.