What Are the Different Ranges of Credit Scores?

Wondering about credit score ranges and where yours is on the scale? Learn more about the total range of credit scores and what is a good credit score range to strive for. [Duration - 1:35]

Highlights:

- Credit scores are three-digit numbers designed to represent the likelihood you will pay your bills on time.

- There's no “magic number” that guarantees you loan approval or better interest rates and terms.

- Credit ranges vary based on the scoring model used to evaluate them.

Credit score is a three-digit number designed to represent your creditworthiness, or how likely you are to repay a lender on time.

Potential lenders and creditors look at your credit score as one factor when deciding whether to offer you new credit. Lenders may also use your credit score to set the interest rates and other terms for any credit they offer.

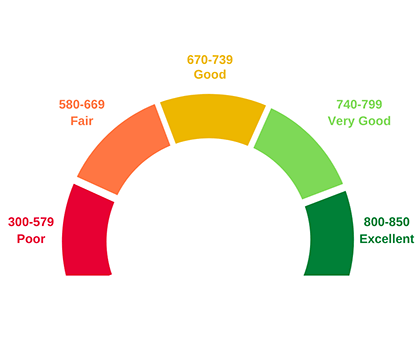

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.

Credit score ranges – what are they?

There's more than one credit scoring model available and more than one range of scores. However, most credit score ranges are similar to the following:

- 800 to 850: Excellent

Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores. - 740 to 799: Very good

Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. - 670 to 739: Good

Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers. - 580 to 669: Fair

Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit. - 300 to 579: Poor

Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, it's likely you'll need to take steps to improve your credit scores before you can secure any new credit.

What is a good credit score?

There's no “magic number” that guarantees you'll be approved for a loan or receive better interest rates and terms. However, in many popular scoring models, borrowers need a minimum score of 670 for their credit to be considered “good.”

Overall, the higher your credit score is, the more likely you are to appeal to lenders. Higher credit scores indicate that a borrower has demonstrated responsible credit behavior in the past. So, they also often receive more favorable terms and interest rates from lenders.

How are credit scores calculated?

Your credit score is calculated using the information found on your credit report. Your payment history, the mix of credit accounts you have, the length of your credit history and your credit utilization rate (the percentage of available credit limits you are using) are all factors that might influence your credit scores.

However, there's more than one way to calculate your credit scores. Lenders and credit reporting agencies often use different scoring models. One model might place the most importance on your payment history. Another could prioritize the types of credit you have available. Because of these differences, your score could vary depending on how it was calculated.

Your scores may also vary based on the credit reporting agency providing them. This is because not all lenders and creditors report information to all three nationwide consumer reporting agencies (Equifax, TransUnion and Experian). Some may report to only two, one or none at all.

How can I improve my credit scores?

The good news is your credit score is not a fixed number. With time and responsible choices, it can be improved. Just keep in mind that this process takes patience. This is especially true if you haven't kept the best credit habits in the past.

Some credit habits that could improve your score in the long term include making your payments on time, keeping old accounts open to lengthen your credit history and keeping your credit utilization rate low.

You'll also want to make sure to keep tabs on your credit report to confirm that the information included is up to date. Credit reports do not include your credit scores, but here are a few ways you can check your credit scores.

Get your free credit score today!

We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required.