How Credit Unions are Helping Foster Credit Access

How Credit Unions are Helping Foster Credit Access

This is a recap of our October 7 Market Pulse webinar, where we discussed the importance of credit unions in gaining access to credit. This month’s Market Pulse webinar started with an economic update and credit union insights from Amy Crews Cutts, Chief Economist at AC Cutts & Associates, and Tom Aliff, Risk Consulting Leader at Equifax. Next, we explored how credit unions and credit union organizations are positioned to help foster access to credit, with guests Cathie Mahon, President and CEO at Inclusiv, and Elizabeth Johnson-Crawford, Chief Technical Officer at Credit Builders Alliance.

Supply Chain Crisis

Real gross domestic product is back to pre-pandemic levels, but not back to pre-pandemic trends, meaning these levels are back to the levels they were at in 2019, but are not back to what we would be at if the pandemic did not happen. From an economist's perspective, Amy Crews Cutts mentioned that there are many areas in the economy that are still showing weakness.

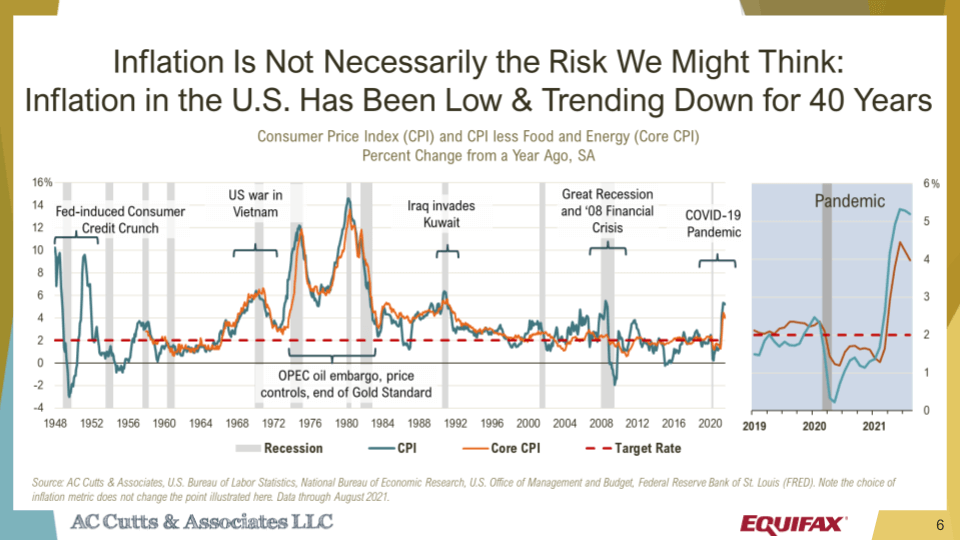

Ending in the early 1980s we had a low and declining inflation for most of the last 40 years with minor exceptions like the financial crisis in 2008. That being said, the inflation levels back then are similar to the levels we are at now. Cutts noted that the chart below is year-over-year and looking at last year prices, one can see the deceleration. When comparing back to two years ago the average inflation rate is about 2.5%. This affects consumers and businesses as prices continue to rise.

However, this is not a high inflationary environment and over the last few months inflation has decelerated. Ignoring inflation news, interest rates have been near record lows and are helping consumers. But, they are starting to show stress from the debt ceiling stalemate.

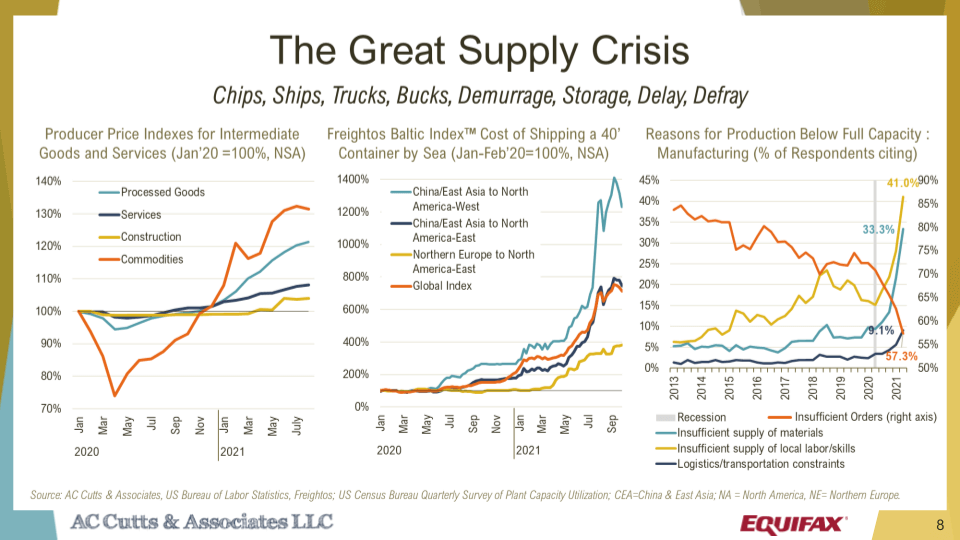

Currently, there is a broken supply chain system and it is a waiting game for when it will be fixed. Cutts showed the producer price index for intermediate goods (below), which showed that building supplies, consumer electronic shortages, and prices are up. Rolling supply delays and rising costs for lumber/other building materials are adding 25-40% to the cost of a new home and extending delivery times by as much as 100%. Insufficient supply of materials, insufficient supply of local labor, and logistics and transportation are all reasons why production is below full capacity and the supply chain crisis is a huge problem.

Economic Update

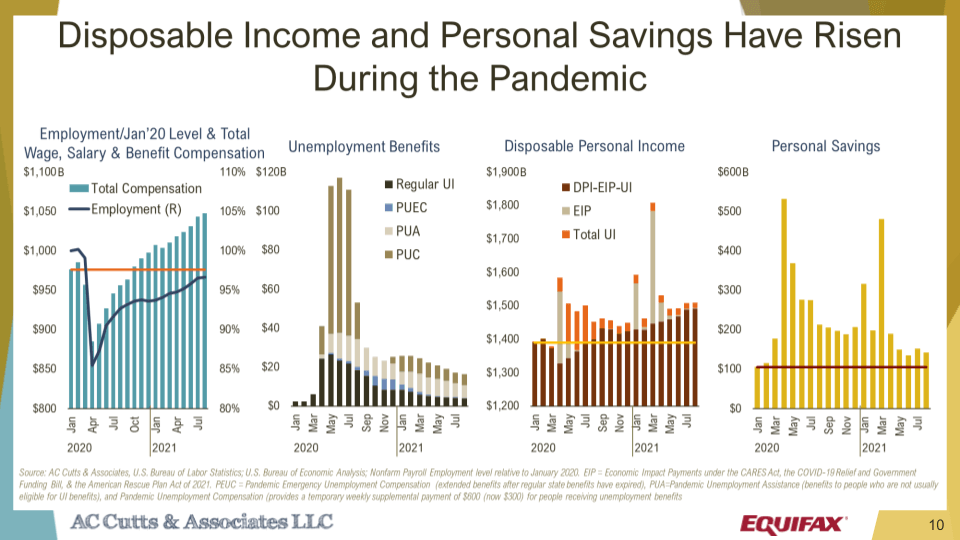

According to Cutts, we have never seen consumer incomes rise during a recession until now. Congress passing the CARES act and support bills have helped businesses and workers. Compensation is up and employment is still down because higher wage workers are remaining with healthy raises. There has also been an increase in wages and salaries trying to attract workers.

The second chart from the left (below), displays the scale of unemployment benefits by type of benefit that shows a 10% of compensation level, which is a big increase. The last chart shows that personal savings have gone up and are above where they were this time last year.

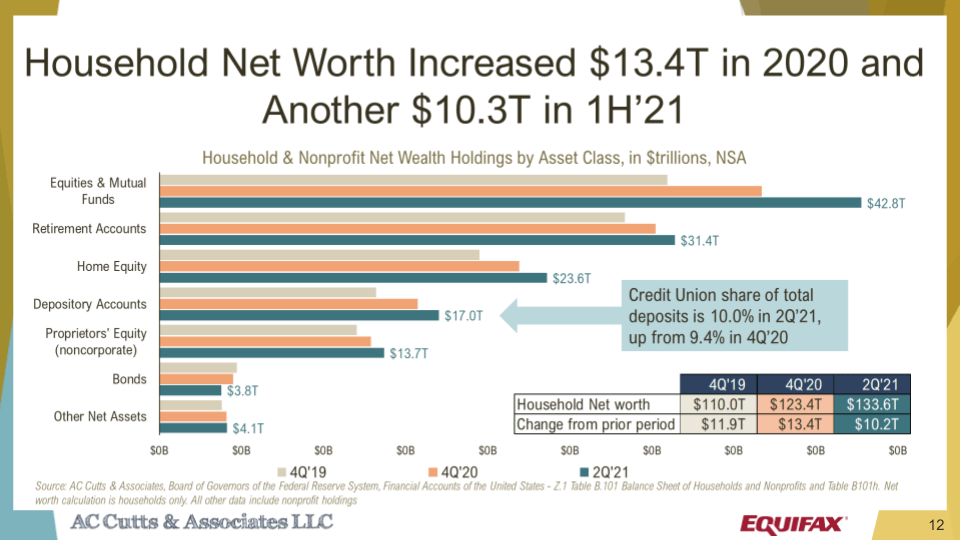

To conclude Cutts’s section on the U.S. economy, she went over how U.S. households are in the best shape ever financially. Total household net worth exploded last year with $13.4 trillion added to household net wealth in aggregate, and another $10.3 trillion in the first half of this year. Also, there has been a tremendous gain in household financial assets like the stock market and deposits. Liquid cash is a big deal and credit unions are about 10% of total deposits, which has gone up since the fourth quarter in 2020.

With Tom Aliff going over credit union insights in the next segment of the webinar, Cutts explained that credit unions are up $1.7 trillion dollars in consumer assets and there is a 15% change since a year ago for the June period and over 20% for 2020.

Credit Union Insights

To start the next part of the webinar, Tom Aliff, Risk Consulting Leader at Equifax, stated that the average U.S. consumer credit scores climbed from 687 in January to 700 in April and since then have leveled off. Subprime increased due to consumers opening fewer new accounts, reducing revolving depth levels, and historically low delinquency levels.

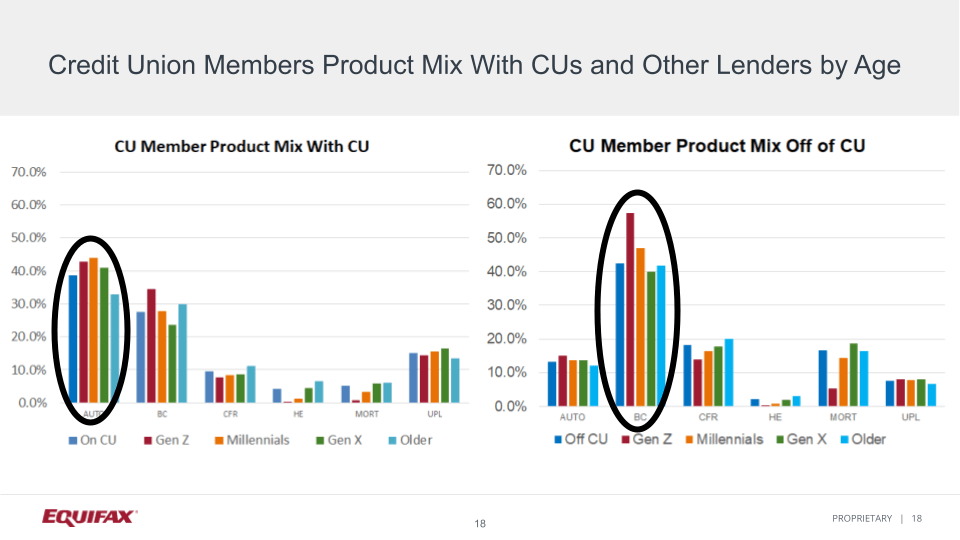

When comparing member and non-member accounts, Aliff stated two out of three auto loans are through credit unions and half of unsecured personal loans are as well. When looking at the product mix by age group (shown below), Aliff stated that Generation Z is in line with the other generations, in that auto loans are a central part of their relationship with credit unions. Off of credit unions, Gen Z is more heavily weighted to bankcards as a portion of their lending product mix then any of the other generations.

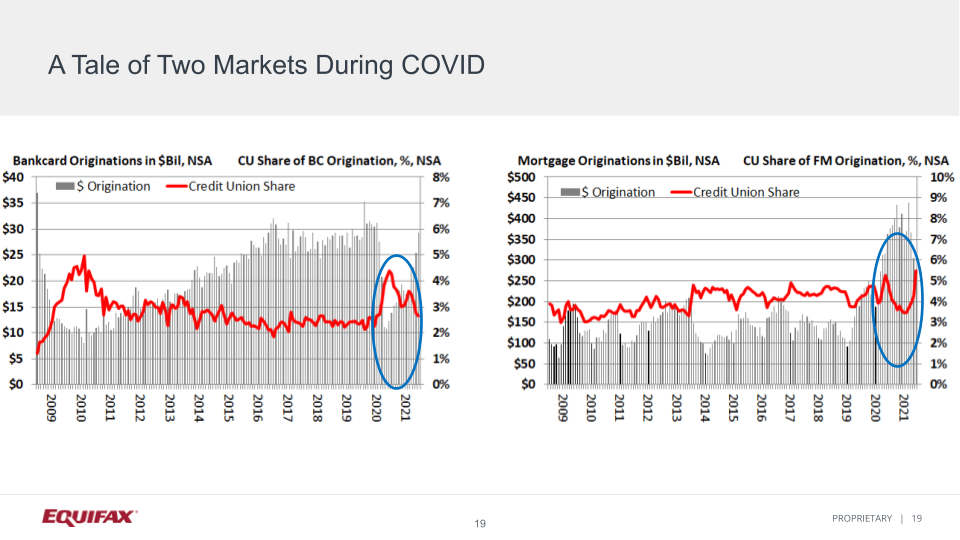

During the beginning of the pandemic, bankcard originations had a steep decline. However, as of recently it has been increasing but is not back to before the pandemic levels. At the same time, the mortgage industry has experienced tremendous growth on the strength of both home sales and refinancing.

According to the chart below, when comparing the performance of credit unions to the rest of the market, we can see the same behavior but to nowhere near the same levels. This means, credit union market share in bankcard originations increased as lenders drew back their activity faster and their share in mortgage originations fell as market heated up. With both of those markets trying to go back to their pre-COVID-19 levels, the credit union market share has adjusted.

Credit Realities

After Aliff, Rissa Reddan, our Market Pulse webinar moderator and Demand Generation Leader of U.S. Information Solutions, introduced Elisabeth Johnson-Crawford, Chief Technical Officer at Credit Builders Alliance. Crawford started by explaining how all consumers do not have equal access to the financial market and affordable credit products, especially communities of color. Mainstream banks tend to place themselves in wealthier communities making it difficult for the less affluent to build good credit history.

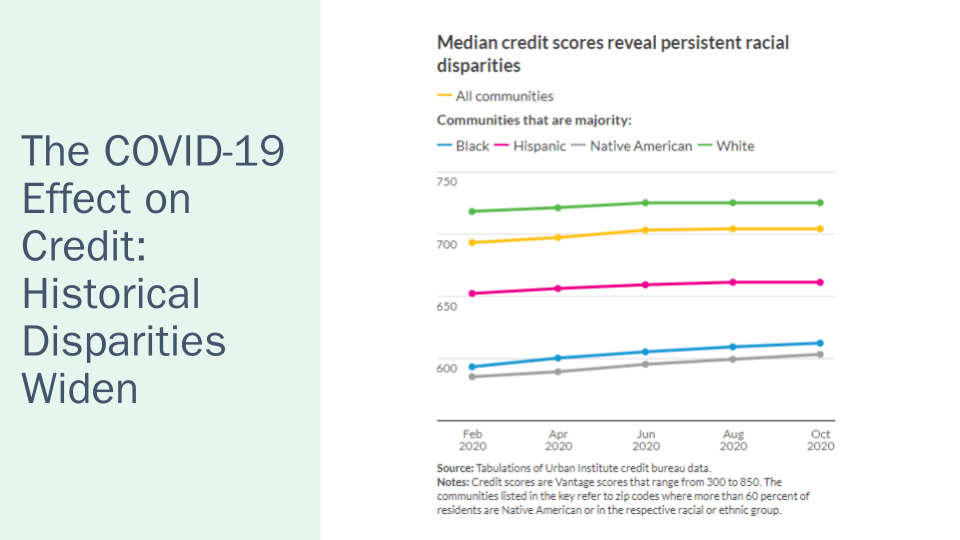

When it comes to the credit invisible, 30% of low income households are credit invisible while upper-income neighborhoods only have 4% of people who are credit invisible. This shows that there are geographical differences and unfortunately, COVID-19 worsened racial disparities (chart below).

Credit Catch-22 is the ongoing cycle where an individual is not able to qualify for credit cards or loans because they do not have good/enough credit. Because of this they are unable to get credit cards or loans which would help them build the credit they need to qualify for these services in the first place. That being said, Crawford believes there is a solution for these individuals through credit building programs and services offered by Credit Builders Alliance, it’s members, and other credit unions focused on providing access to credit for the underbanked communities. Credit Builders Alliance helps by reducing the barriers for these individuals and believes good credit is an asset.

Best Practices for Credit Access

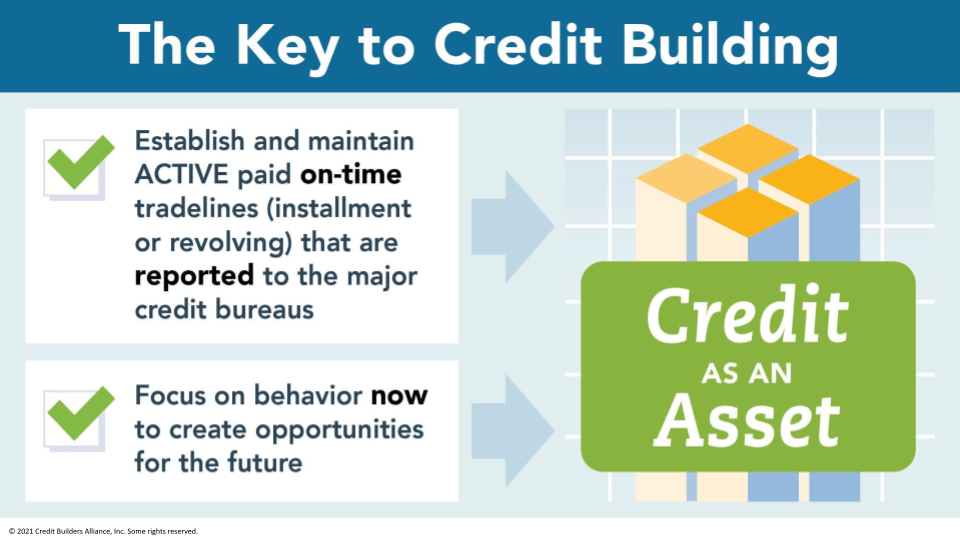

On the slide below, Crawford went over what CBA does to help individuals build credit. The key includes establishing active, paid on-time tradelines that are reported to the major credit bureaus, while focusing on the behavior now to create opportunities for these individuals in the future. CBA works with nonprofits to create opportunities for their members to increase their financial literacy and build positive credit history.

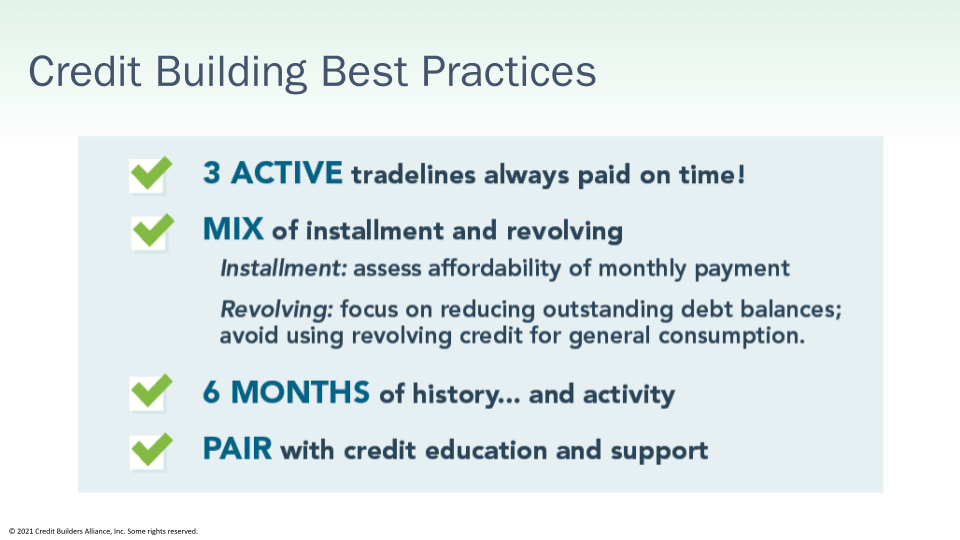

Next, Crawford went over some best practices (below) that CBA teaches its members, which helps them make it achievable and possible for their clients to build positive credit. First, CBA recommends that individuals have at least three active tradelines always paid on time.

Second, creditors prefer to see a variety of accounts and both installments and revolving trades require different types of behavior. Having a mix of installments is important. The third best practice is to have patience, as it takes time to build a credit score. For example, with FICO it takes six months of history and activity to build a FICO credit score. With credit, if you don’t use it, you lose it.

Credit is a lifetime process, and requires long-time care. The last best practice from Credit Builders Alliance is to pair credit education and support with credit products. CBA knows there is so much credit information and as a company they want to ensure that the right information is shared with their members. Implementing these key points can lead to credit success, however for some individuals it may not be or sound that easy. That’s why honing the simplicity message and these key points can lead to successful credit building. According to Crawford, once an individual builds their credit they can improve their financial health.

Credit Builders Alliance

Crawford concluded her portion of the webinar by providing our viewers with what Credit Builders Alliance has to offer. CBA’s platform has four levels of impact in pursuit of its mission:

- Organizational level: CBA helps nonprofits start or enhance their credit building programs through its’ CRA services which enables nonprofit organizations to report loan data and pull credit reports through partnerships with several consumer reporting agencies.

- Practitioner level: CBA provides training and technical assistance on credit and credit-building.

- Industry level: CBA supports the replication and promotion of innovative and responsible credit building products.

- Policy level: CBA advocates for consumer friendly policy changes within the credit industry itself.

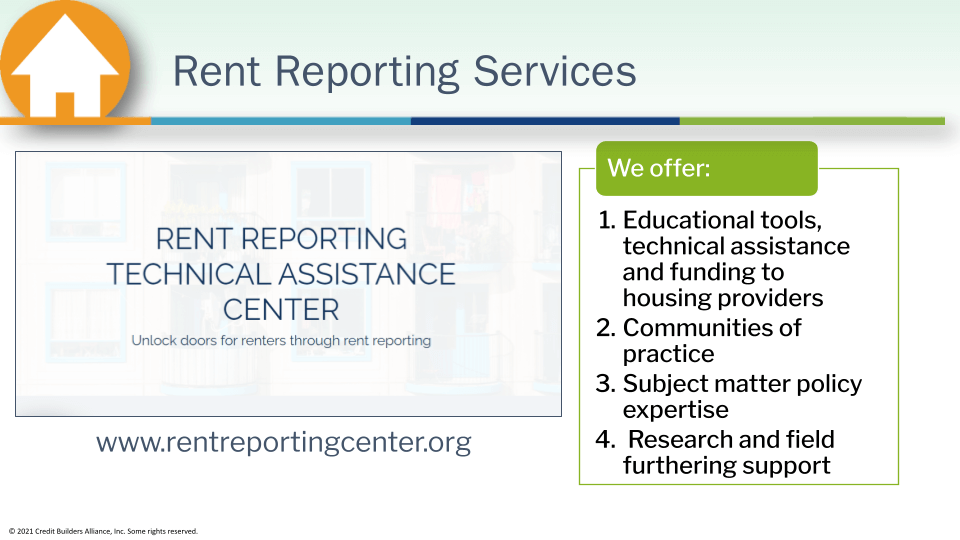

With Credit Builders Alliance’s three platform services; access, reporter, and training and consulting, CBA is able to provide credit building help to many individuals. Crawford ends her presentation by providing information on how renters can implement their rent reporting services (shown below) which offers educational tools, technical assistance, and funding to housing providers.

Building a More Equitable Financial System

Cathie Mahon, President and CEO at Inclusiv, concluded the webinar. Mahon started off by providing ways to dig deeper into the marketplace and build a more equitable and inclusive place. Community credit development unions are the financial first responders and have been delivering targeted relief to communities in distress and Inclusiv is one of them. Inclusiv like many other credit unions is an alternative to a bank.

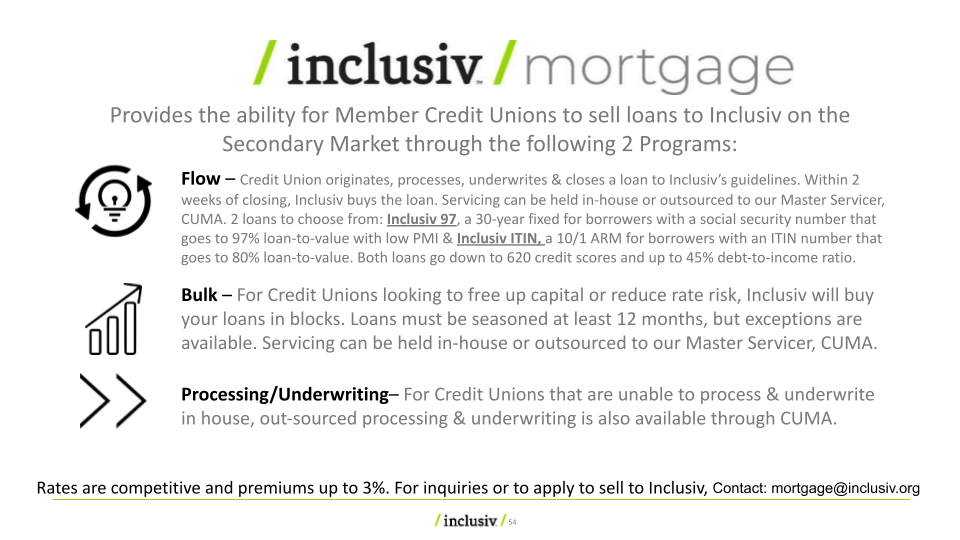

Next, Mahon highlighted the importance of credit unions. Credit unions are required to maintain 7% or greater in net worth and must grow net worth to keep pace with the market/share growth. When it comes to the mortgage space, credit unions have been gaining market share but have been conservative with their lending. They are at risk of losing market share. That is why non-conforming mortgage products are thinking outside the box and Inclusiv is here to help with that. Inclusiv runs a secondary market for nonconforming mortgages. Credit unions that are interested in testing non-confomring mortgages can have Inclusiv take a second look at loans that typically would be declined because the loans may not fit the traditional credit box.

According to Mahon, another service Inclusiv offers is its Center for Resiliency and Clean Energy. Inclusiv’s center builds and supports a network of credit unions in designing and scaling financing solutions that combat climate exchange, improve community resilience, and increase access to affordable and sustainable energy for all people.

Mahon concluded her section by mentioning the partnership Inclusiv has with Equifax called On the Rise. This partnership delivers one-on-one financial coaching in one of the lowest income areas in Atlanta. This pathway, now national (shown below), combines technology financial coaching with credit union financial products to increase financial health and inclusion in these communities.

Watch a replay of our webinar, “Market Pulse: The Role of Credit Unions in Credit Access” or download a copy of the presentation. Read our Q&A blog here.

* The opinions, estimates and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you