capabilities

how

resources

insights

Insights From Our Experts

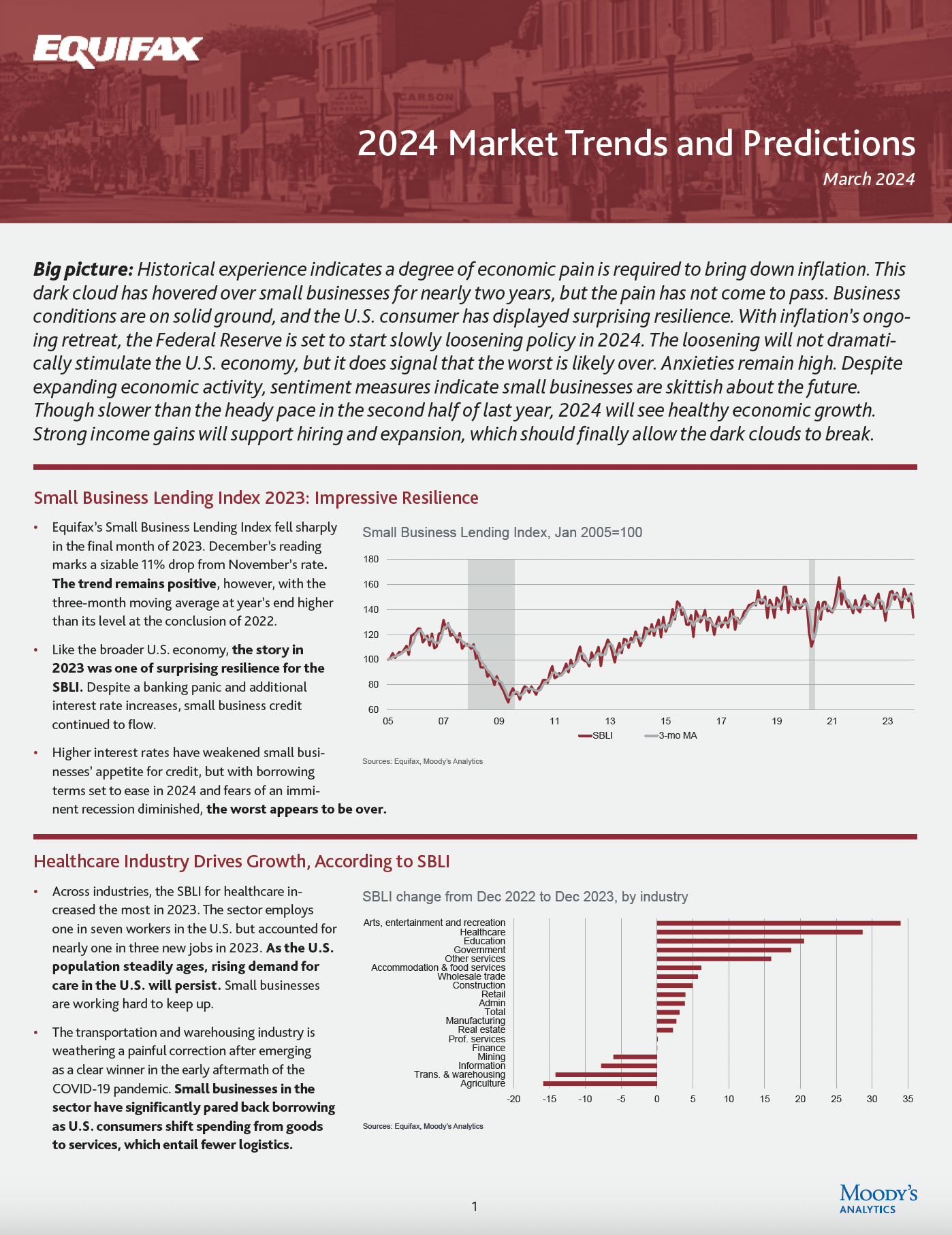

- April 19, 2024 Small Business Resurgence: Insights and Trends for the Year Ahead We are in unparalleled territory when it comes to the small business landscape. In this blog, we'l [...]

- April 18, 2024 Regional Trends: Small Business Delinquency Index Predictions for 2024 33.3 million businesses in the United States qualify as small businesses. 1 In recogniti [...]

- March 28, 2024 Beyond the Numbers: Answering Your Burning Questions on Delinquency, Interest Rates, and More During March’s Market Pulse webinar, we gave our audience what they have been requesting: extended [...]

- February 29, 2024 Q1 Check-In: Align Goals in a K-Shaped Economy As we are solidly into 2024 Q1, it is the perfect time to reevaluate our financial resolutions. We [...]

- February 22, 2024 Revving Up: Essential Strategies for Succeeding in the Evolving Auto Market of 2024 Shift into high gear In our energetic February 2024 Market Pulse webinar, our experts p [...]

- February 13, 2024 FAQ: What is a K-Shaped Economy? Many hope for a post-pandemic fresh start. The reality is that the financial landscape is a K-shap [...]

- February 01, 2024 Understanding Affordability in Terms of 2024 Market Trends Our January Market Pulse webinar discussed all aspects of affordability in our current financial m [...]

- January 18, 2024 Unlocking Opportunities: Smart Lending in the K-shaped Economy of 2024 2024 opens in a K-shaped economy. In this environment, consumer budgetary pressures look different [...]

- December 12, 2023 Looking Back on 2023 and Focusing on Forward for 2024 During the final Market Pulse webinar of 2023, we took a look at the past year’s economic and cons [...]

- November 21, 2023 Navigating Global Economic Headwinds: Insights from Market Pulse Webinar In the dynamic realm of global markets, staying abreast of the latest trends is imperative for ind [...]

- September 25, 2023 Market Pulse Webinar: How to Strengthen Origination Resilience In the fast-paced world of finance and economic policy, staying ahead of the curve is essential fo [...]

- September 20, 2023 Small Business Indices: Show the Effects of Tighter Credit Conditions In July 2023, small business lending and financial stress exhibited distinct regional and industry [...]

- August 01, 2023 Beyond Credit Scores: Why the Whole Consumer Matters In a murky and mysterious economic landscape, there can be uncertainty and hesitation. In July’s [...]

- April 06, 2022 The U.S. Economy and Consumer Wealth in 2022 This month’s Market Pulse webinar presenters included Dylan Hall, Co-Founder and CEO at Safe Rate; P [...]

- March 10, 2021 Q&A: Return to Opportunity for Commercial Real Estate Updated 5/11/2023: The White House declared the end of the Covid-19 Health Emergency May 11, 202 [...]

contact

Need Help Deciding?

Connect with our sales team today to get a product consultation.